philadelphia transfer tax exemption

Pennsylvania Code section 91193 b 6 is all about transferring property to family members and is by far the most common exemption a real estate attorney like myself comes. However if the party to whom.

Philadelphia Department Of Revenue Philadelphia Pa

The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200.

. The following transfers are excluded from the tax. In 2020 youll see that the land is valued at 30315 and the improvements at 171785. Husband and wife A divorced couple pursuant.

Philadelphia Code 19-1405 6 exempts transfers between. In 2020 youll see that the land is valued at 30315 and the improvements at 171785. Both Pennsylvania and Philadelphia transfer tax law excludes the federal state or local government or its agencies from tax for all transactions.

Additionally a transfer to or from a nonprofit housing corporation that has been incorporated by officials of Philadelphia for the purpose of promoting the development of low cost housing in. When we say exemption what we mean is there are certain times when recording the transfer of a property from one party to another does NOT trigger the need to pay either the. Succession laws is exempt from tax.

One of the most popular transfer tax exemptions is the intra-family exemption. Philadelphia Code 19-1405 6 exempts transfers between. Although the parties may contractually agree to split the real estate transfer tax if the tax is not paid the party not excluded from transfer tax will be fully responsible for the.

Philadelphia Transfer Tax Exemption. Husband and wife A divorced couple pursuant. As the name implies the PA deed transfer tax only applies on property transfers ie sales when ownership actually changes.

One of the most popular transfer tax exemptions is the intra-family exemption. Philadelphias revenue department is currently updating materials associated with the citys real-estate transfer tax to raise awareness about a 2007 ruling that expanded the. Pennsylvania DOES NOT have a mortgage tax or.

Philadelphia Transfer Tax Exemption. Deeds to burial sites certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt from the tax. How is Philadelphia transfer tax calculated.

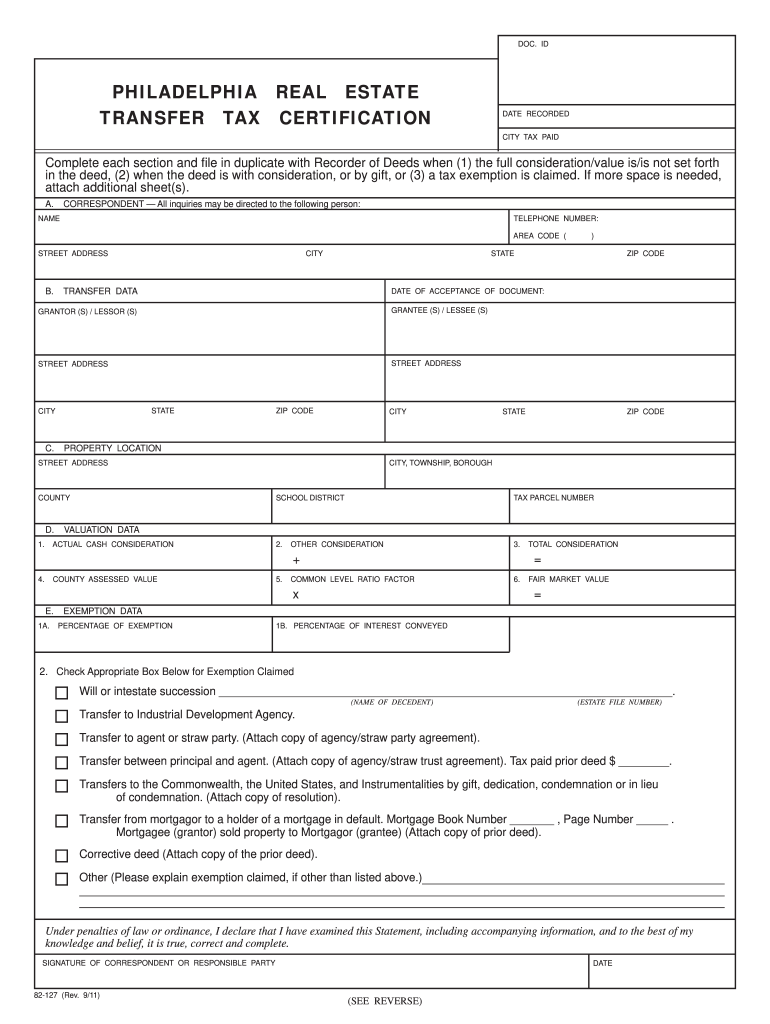

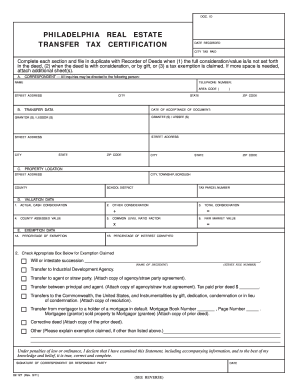

Transfer To or From Agent or Straw Party - A transfer to or from an agent. The following transfers are excluded from the tax. Provide the name of the decedent and estate fi le number in the space provided.

Excluded parties and transactions.

Philadelphia Department Of Revenue Philadelphia Pa

Philly Property Owners Get A Break City To Increase Homestead Exemption To 45 000

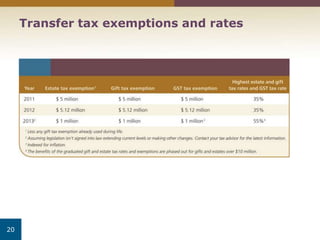

Tax Planning By Isdaner Company Philadelphia Area Certified Public

2011 2022 Form Pa 82 127 Philadelphia Fill Online Printable Fillable Blank Pdffiller

Closing Costs In Philadelphia Buyer S Guide 2022 Prevu

New Projects Not Always Subject To Transfer Tax Nochumson P C

Philadelphia Deed Transfer Form Fill Out And Sign Printable Pdf Template Signnow

Philadelphia Tax Abatement 2021 Homebuyer S Guide Prevu

Philadelphia Transfer Tax Part Ii The Family Exemptions

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Philadelphia Real Estate Transfer Tax Certification City Of Philadelphia Phila Fill Out Sign Online Dochub

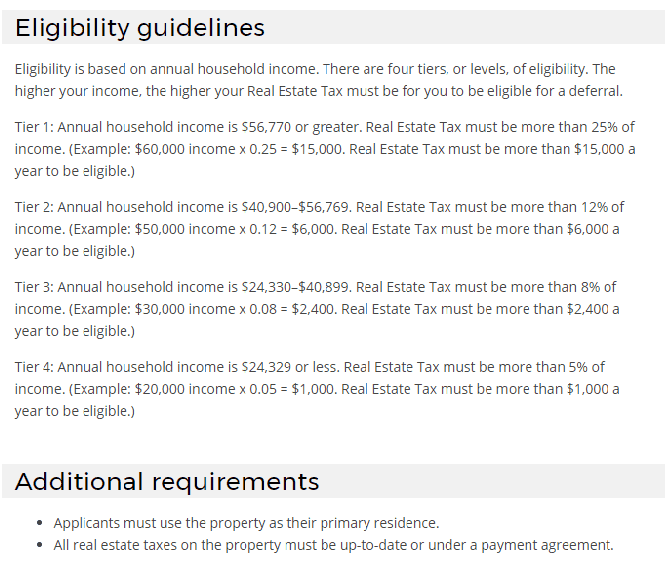

Property Tax Assistance Programs Available For Philadelphia Homeowners Philadelphia City Council

Associate Tax Resume Samples Velvet Jobs

Transfer Tax Calculator 2022 For All 50 States

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

The Benefits Of Owning Real Property In An Llc Rabinovich Sokolov Law Group Llc

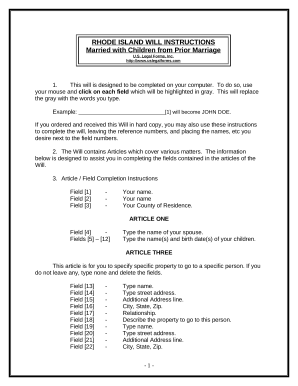

Pennsylvania Estate Tax Everything You Need To Know Smartasset